Should you care to read the book ‘Diamonds in the dust’?

It’s been a few weeks that I finished reading this book called ‘Diamonds in the dust’ and since then I was meaning to write an article about what I learned from this book.

Now, I appreciate the fact that different people learn different things from the same book. And I also appreciate that with some books when you read them 1/2/3 times you takeaway something new each time. I hope my readers will appreciate that this is my personal view on the book and it might be different from anyone else. (Fun fact: I picked this ‘1/2/3’ style of writing from the book itself as it’s often used in it 🙂 )

Before I start talking more about the book, a little bit about how I got my hands on this book. I was recommended this book by one of my friends in India who is a Gen Z DIY investor. Not just the book I was recommended to research more about the main author Saurabh Mukherjea. And since then I’ve listened to many of Mukherjea’s talks on youtube and continue doing so.

In my humble opinion, Mukherjea and team seem like reasonable fellows who have a clearly defined investing strategy tailor made for Indian equities market.

Okay, now comes some matter-of-fact information about the book. The book is divided in to seven chapters emphasing on various aspects of investing like,

- Common myths in Indian investing.

- How to judge Indian companies based on accounting quality, ROCE, reinvestment strategy and capital allocation.

- Is it worth trying to time the market?

- Preparing an investment plan.

- And lastly, conclusion and Appendixes

What I liked the most about the book is, it not only makes a strong point but also supports it with factual information and case studies. Also, the case studies and all the data is specific to Indian listed companies and Indian indexes which make the book very relevant to Indian stock market.

The book does a fantastic job in debunking a popular theory – ‘Higher returns from stock market are proportional to higher risks’

The book presents data which shows that CAPM is completely useless in India — not only do the highest-risk stocks (high-beta stocks) NOT deliver the highest returns, the stocks which do deliver the best returns are actually low-risk stocks (i.e., low-beta stocks with low share price volatility).

The book explains why CAPM (Capital Asset Pricing Model) does not work in Indian equities market but crushing risk does!

The book then goes on explaining how to assess companies based on the quality of their accounting, their ROCEs and reinvestment rates and their capital allocation strategies. All this is explained by analysing some new, some old and some very old and even busted companies in India. There’s a whole bunch of case studies based on companies like Ricoh India, Manpasand Beverages, Cox & Kings, Amtek and many more.

It has a separate chapter for identifying ‘mischievous’ accounting practices in financial services companies citing a case study about DHFL which went bankrupt not too long ago.

Wait, that’s not all! In the Conclusion part, the book emphasizes the importance of behavioural skills along with technical abilities by comparing test cricket with investing. The book praises Rahul Dravid for mentally training himself to introspect and review his previous decisions/actions, identify deficiencies and also identify remedies to them. The book draws an analogy between test cricket and invessting and emphasizes the importance of having a growth mindset along with technical skills in order to become a successful investor.

The only con I found in the book was in the last chapter on ‘Preparing an Investment Plan’. Here, the book recommends the authors’ own portfolio management company and some of their portfolios which I thought was conspicuously self-promoting.

But all in all it’s a great read, in an easy to understand language packed with real data about real companies in India. In fact, there’s so much information in the book that one has to keep coming back and almost use this book as reference material. I definitely recommend this book to anyone who is a DIY investor and wants to analyse companies to add to their portfolio. And anyone who is contemplating investing in Indian equities market will also find great value in the information presented in this book.

I hope you enjoyed reading this article.

Happy investing.

So long.

Trivial pursuit

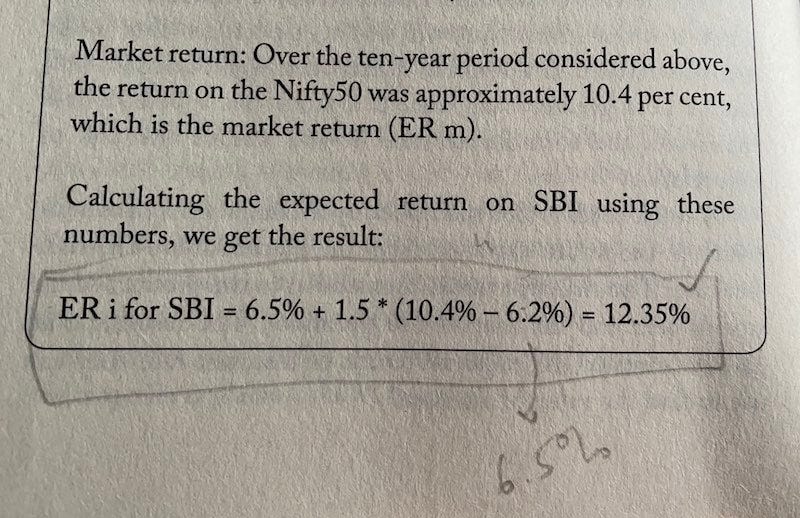

I discovered a little typo mistake on page 20 of the book where it calculates CAPM for SBI using the CAPM formula,

ER i = R f + β i (ER m — R f)

Although the final value 12.35% is correct, the R f value is incorrect.