The key difference

We all know that you can invest in mutual funds broadly in two ways (there’s another way — IDCW but I’ll leave that for a later post); Regular Plan and Direct Plan. We also know that you can earn better returns if you choose the Direct Plan as against the Regular Plan. But have you wondered how much of a difference it would make in terms of actual returns?

In today’s article, I initially wanted to show you and explain actual mutual funds returns that I made from redeeming some of my UTI Mutual Funds in May 2023. I wanted to explain how the NAV calculations work and how TDS is deducted before the amount gets credited to your bank account. But as I started preparing for the article, curiosity got the better of me and at the end I also discovered how much expense ratio eats into your gains.

The reason you make more by investing in a Direct Plan as against a Regular Plan is the expense ratio.

This expense ratio is incorporated in to the NAV of a fund and you might never know the details of how the NAV was arrived at in the first place but just remember, lower expense ratio will give you a higher NAV.

I’ll explain this with an example. Mind well, the example below is not a hypothetical one but this is a real example from my own mutual fund portfolio. So here goes part 1 of the article…

Part 1

I had started investing in the UTI Banking and Financial Services Fund somewhere around the beginning of the coronavirus pandemic in 2020. I chose a direct plan growth option and started an SIP. From time to time, I also topped up in lumpsum manner whenever I saw that the NAV of the fund had come down and most importantly when I had surplus money to invest 🙂 Please note this is not an investment advice or a fund recommendation. I am invested in other mutual fund houses as well as other funds from the same house.

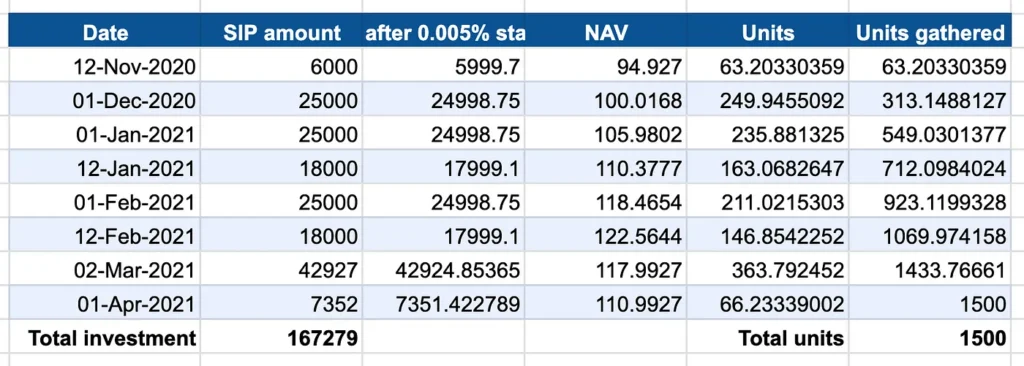

So, below is the snapshot of my account statement of UTI Banking and Financial Services Fund.

As you can see I made additional purchases on 12-Jan-2021 and 12-Feb-2021. I also transferred some money using STRIP from a UTI Liquid Mutual Fund into this fund on 02-Mar-2021. Overall, the total investment was Rs.1,67,279 (One lakh sixty seven thousand two hundred and seventy nine rupees).

On 24-May-2023 when I saw that the market recovered somewhat and the NAV was good for me to book some profit, I redeemed these 1500 units. The NAV on that day was Rs.144.7822 (One hundred and forty four point seven eight two two rupees). This made redemption amount (144.7822 * 1500) of Rs.2,17,173.3 (Two lakh seventeen thousand one hundred and seventy three rupees).

Total gain was 2,17,173.3 – 1,67,279 = 49,894.3 (Forty nine thousand eight hundred and ninety four rupees) over a period of two and half years.

Please note TDS @ 10.40% was deducted since this was a long term capital gain and the post-tax gain was around Rs.44,696.13 (Forty four thousand six hundred and ninety six rupees). Also, if you are a DIY investor like me, you realise why keeping a track of the NAV is so important.

Keeping a track of NAV and redeeming at a high NAV makes a lot of difference.

So far so good? Now, lets see how much I would have made if the same investments on the exact same dates were made in the same fund but in a Regular Plan. Ready?

Part 2

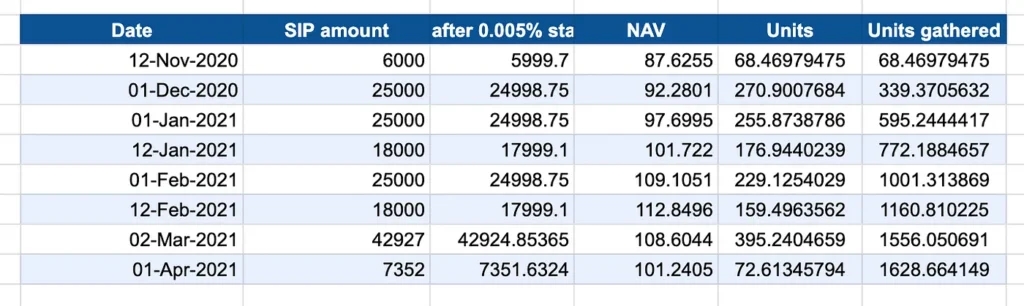

For this I needed some historic NAVs and while searching for the same online, I stumbled upon this very reliable source for historic NAVs on the Association Of Mutual Funds in India (afml) website. Using those, I made up below snapshot of my “would have been” account statement of UTI Banking and Financial Services Fund had I invested in the Regular Plan.

As you can see, I would have accumulated more units since the NAV was lower than the Direct Plan. Wait a minute! This seems counter-intuitive, doesn’t it? Wasn’t I supposed to make more gains through Direct Plan as compared to Regular Plan?

That’s right! Now, here comes the magic 🙂

At the time of redemption, on 24-May-2023, I would have redeemed 1628.664 units at a much less NAV of Rs.129.9176 (One hundred and twenty nine point nine one seven six rupees) thanks to the expense ratio. This makes redemption amount (129.9176 * 1500) of Rs.2,11,592.1 (Two lakh eleven thousand five hundred and ninety two rupees).

Total gain would have been 2,11,592.1–1,67,279 = 44,313.1 (Forty four thousand eight hundred and ninety four rupees)

Now, you might wonder why was the NAV different for the two options? And the answer is expense ratio. In simple terms, expense ratio is the cost incurred by the fund house in operating the fund.

So, lower expense ratio means higher NAV and better returns.

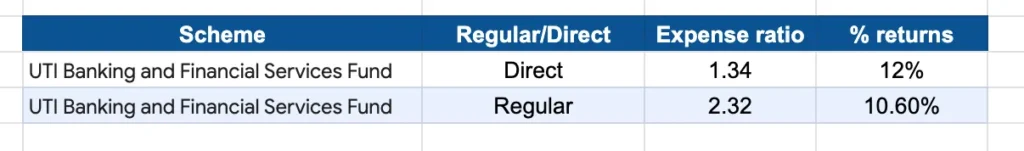

That’s a whopping five and half thousand rupees more gain in Direct Plan than in Regular Plan. In terms of percentages, in above scenario, Direct Plan investment made nearly 12% and Regular Plan investment would have made 10.6% returns. Here’s a snapshot of comparison between the two.

So there, this is how much the expense ratio eats into your gains at the time of redemption. Now you not only know that you make better returns investing in a direct plan but you also know how much better and why.

I hope you found this example easy to understand.